The Australian Modular Construction Landscape: A Comprehensive Technical Analysis

Dimensions, Logistics, and Structural Methodologies

1. Introduction: The Volumetric Paradigm

The Australian construction industry is undergoing a significant structural transformation, pivoting from traditional linear, on-site fabrication to parallel, off-site manufacturing. This shift toward modular or volumetric construction offers profound advantages in speed, quality control, and safety. However, it introduces a complex new set of constraints that do not exist in the in-situ world: the limitations of the logistics network.

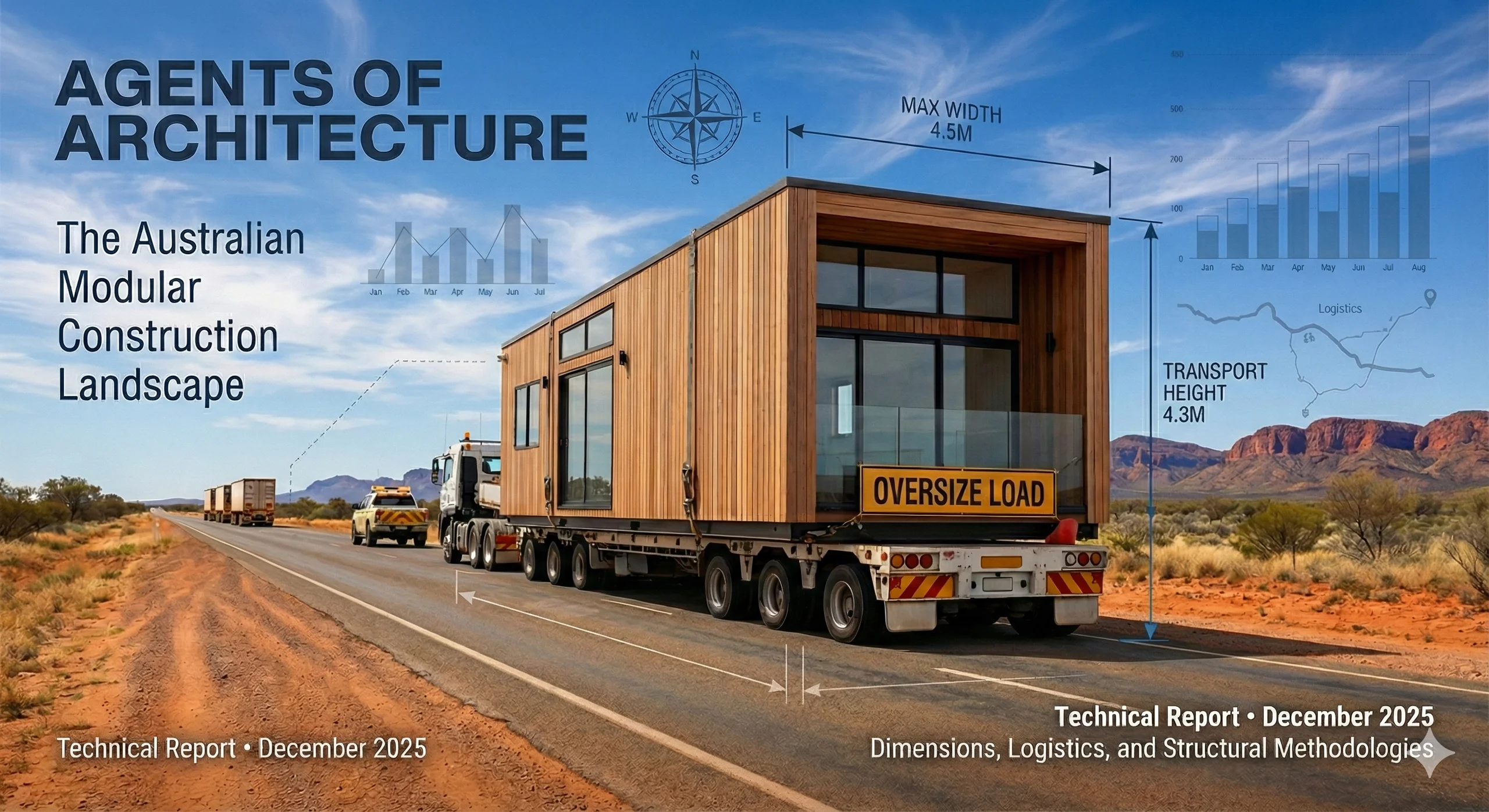

In traditional construction, a building’s dimensions are limited primarily by the site boundaries and structural physics. In modular construction, the building is defined by the "transport envelope"—the rigid three-dimensional box that can legally and physically move along Australia’s road network.

This report provides an exhaustive analysis of the standard modular building sizes across the Australian market, categorizing suppliers into Commercial/Industrial and Residential/Architectural sectors. It details the precise width, length, and height thresholds that dictate cost and feasibility, offering a nuanced examination of the structural and design challenges inherent in volumetric construction.

The Geometry of Transport

In the Australian modular industry, design is logistics. Building dimensions are dictated by the road network.

Golden Width

3.0m

Cost-effective transport limit (No Pilot)

Std Max Length

12.0m

Optimal for semi-trailer decks

Std Ceiling

2.4m

Standard commercial internal height

Wide Load Trigger

3.5m

Requires Pilot Vehicle (Major Cost)

2. The Regulatory and Logistical Framework

To understand the dimensions of Australian modular buildings, one must first understand the Heavy Vehicle National Law (HVNL). A modular building, once loaded onto a truck, ceases to be architecture and becomes a "load." Its viability is determined not by the Building Code of Australia (BCA) initially, but by the road access permits managed by the NHVR and state bodies.

2.1 The Width Hierarchy

Width is the single most critical dimension in modular logistics. It determines the "swept path" of the vehicle and the level of safety escort required. The cost of transport increases in discrete "step functions".

The Width Spectrum

Width is the primary cost driver. 3.0m is standard, while 3.5m+ triggers heavy penalties.

- ✓3.0m: Industry workhorse. Cheapest to move.

- ⚠3.5m - 4.4m: Requires "Oversize" designation & pilots.

- ✗>4.5m: Police escorts & route surveys.

Australian Supplier Module Width Frequency

Tier 1: The Standard Gauge (< 2.5m)

Fits within standard truck footprint. No permits. Typically for ablution blocks and site storage.

Tier 2: The Efficiency Sweet Spot (3.0m – 3.5m)

Oversize but often low risk. Avoids pilot vehicles in many jurisdictions during daylight. Ideal for commercial hire fleets (Ausco).

Tier 3: The Piloted Range (3.51m – 4.5m)

Requires at least one pilot vehicle. Standard for residential modular (Modscape, Anchor Homes). The extra width transforms internal livability.

Tier 4: The Complex Range (4.51m – 5.5m)

High risk. Often requires two pilots. Transport costs double compared to Tier 3.

Tier 5: The "Super Load" (> 5.5m)

Critical risk. May require police escorts ($263/hr in NSW), utility wire lifting, and night travel.

The "Wide Load" Economy: Transport Cost vs. Width

The relationship between width and cost is not linear—it is stepped based on regulatory tiers. Note the vertical wall at 5.0m where Police Escorts become mandatory.

Standard Load

$4.50 / km

Width < 2.5m (Standard Semi)

Oversize (Pilot)

$14.00 / km

Width 3.5m - 4.4m (1-2 Pilots)

Super Load (Police)

$55.00+ / km

Width > 4.5m (Police Escort)

Why the price jump?

- TIER 1< 3.0m: Standard truck rates. Minimal permits. No escorts.

- TIER 23.5m - 4.4m: Requires "Oversize" signs and 1-2 Certified Pilot vehicles ($2.50/km per pilot).

- TIER 3> 4.5m: Police Escort Required. Includes hourly police rates (min 4hrs), 2x Pilots, and often electrical utility crews.

Why Police? (The Geometry of 4.5m)

It is a common misconception that police are only needed in cities. The requirement is dictated by Lane Encroachment.

Standard Lane Width: 3.3m - 3.5m

A 4.5m load is 1.2m wider than the lane.

In Rural Areas: A 4.5m+ load on a single-lane highway physically blocks oncoming traffic. Private pilots cannot legally force cars off the road—only Police have the authority to close the highway.

Road Corridor Schematic

BLOCKED

OCCUPIED

2.3 Height Constraints: The 4.6m Ceiling

Australia’s road network has a nominal clearance height of 4.3m to 4.6m. This creates a "sandwich" problem for vertical design.

Trailer Type & Height Limits

The 4.3m Limit

Road transport generally limits loaded height to 4.3m. If the truck deck is 1.0m, the module is limited to roughly 3.3m.

The Chassis Penalty

Modular buildings sit on a steel chassis (250-350mm). This eats into vertical allowance, making high ceilings challenging.

The Critical Path: Concept to Completion

Feasibility & Logistics

The "Go/No-Go" Gate. Before design begins, verify NHVR route access and crane positioning. A site with poor access kills the project immediately.

DfMA (Design)

Design for Manufacture & Assembly. Architects must design to the module, aligning join lines with hallways and ensuring service risers stack. This is engineering, not just sketching.

Parallel Works

The Speed Advantage. While the factory builds the modules, site teams pour footings and run services. These streams must converge perfectly at the installation date.

Factory Acceptance (FAT)

The Quality Check. Clients inspect the fully finished modules in the factory. Defects are fixed before shipping, avoiding expensive site call-outs.

The Lift

The High Stakes Day. Modules arrive on trucks and are craned onto prepared footings. Precision is key—tolerances are <2mm.

Complexing

Stitching it Together. Roof flashings are sealed, services connected, and marriage walls plastered. The "modular" look disappears.

3. Comprehensive Supplier Analysis

The Australian market is bifurcated into Tier 1 (Commercial/Industrial), focused on fleet efficiency, and Tier 2 (Residential/Architectural), focused on design maximization.

3.1 Commercial & Industrial (Fleet Model)

- Ausco Modular: The hire market giant. Standard 12.0m x 3.0m modules. Stackable and robust.

- ATCO: Mining and resources focus. Blast-resistant capabilities.

- Fleetwood: Education and corrections infrastructure.

3.2 Residential & Architectural (Custom Model)

- Modscape: Fully welded steel frames. "Modbotics" automation.

- Archiblox: Sustainable focus. Pushes dimensions up to 16m length.

- Anchor Homes: Rural/Lifestyle focus with zone-based pricing.

3.3 Boutique & Design-Led Modules

- Ample Co: Design-led small modules ranging from permit-exempt "Little Fella" (4.5m x 2.5m) to the luxury "Retreat" (15.0m x 5.0m). They specialize in high-end finishes and sustainable principles for smaller footprints.

Strategic Risk Matrix: The "Killer" Variables

Modular construction shifts risk rather than eliminating it. In the Australian context, the risks move from "wet weather" (traditional) to "logistics and finance" (modular).

1. Builder Insolvency (Critical)

Unlike traditional builds where you pay for work done, modular often requires large deposits for off-site materials. If the factory goes under, you lose your capital and your asset.

2. NHVR Permit Rejection

Designing a 4.5m wide module before securing the route permit is the most common catastrophic error. If a bridge clearance fails, the building cannot be delivered.

3. Bank Valuation

Banks often classify incomplete modules as "chattel" (like a caravan) rather than real estate, refusing to release progress payments until the unit is fixed to the site.

4. Crane Logistics & Site Access

It's not just the lift weight, it's the radius. A 5T module might require a 130T crane if placed 25m back. Factor in "mobilization" (travel cost for the crane) and physical access for these massive vehicles, and the lift cost can easily double.

Conclusion

While "standard" sizes exist—most notably the 12.0m x 3.0m commercial module—the residential sector frequently pushes these boundaries to achieve architectural intent, accepting the exponential increase in transport logistics costs.

For developers and architects, the key takeaway is that dimension is cost. Understanding the 3.0m, 3.5m, and 4.5m thresholds allows for "designing to the truck," potentially saving tens of thousands in logistics fees without compromising the fundamental utility of the building.

Reference Data

Table 1: Supplier Capability Matrix

| Supplier | Sector | Std Widths | Max Width | System |

|---|---|---|---|---|

| Ausco | Commercial | 3.0m | 3.5m | Steel |

| Modscape | Residential | 3.5-4.5m | 5.0m | Steel |

| Archiblox | Residential | 3.8-4.5m | 5.0m | Timber/Steel |

| Anchor | Lifestyle | 3.5-4.5m | 4.8m | Timber |

| Ample Co | Boutique | 2.5-4.5m | 5.0m | Steel/Timber |

Planning a Modular Project?

Navigating logistics and dimensions is critical for feasibility.

Get Expert Advice